Het one-stop-shop platform dat voorziet in al je behoeften voor het kopen, verkopen en verhuren van onroerend goed.

Zoek in onze geavanceerde en volledig uitgeruste database van huizen, appartementen en andere vastgoedobjecten. Stel een alert in en je ontvangt de details rechtstreeks in je inbox.

Wil je je huis verkopen? Maak een lijst van topmakelaars in je omgeving. Vergelijk hun kosten en diensten en kies de juiste makelaar voor jou.

Van studentenverhuur tot studio's, vrijstaande woningen of zelfs penthouses. Wat voor huis je ook zoekt, wij zijn er om je te helpen met het grootste aanbod huurwoningen van Dutch Caribbean.

Veilige en transparante toegang tot financiële diensten voor de

Nederlandse Cariben

In een hoog tempo breiden wij online uit om onze regionale dekking, productselectie en toegang tot betrouwbare dienstverleners te vergroten.

Curaçao is een deelstaat van het Koninkrijk der Nederlanden en ligt in het zuiden van de Caribische Zee. Net als het buureiland Aruba heeft ook Curaçao een gevestigde en diverse financiële dienstensector. Het fungeert als een regionaal financieel centrum en biedt een scala aan financiële diensten aan zowel binnenlandse als internationale klanten.

De financiële dienstverlenings-sector op Aruba is een essentieel onderdeel van de economie en speelt een belangrijke rol in de ondersteuning van de toerisme-gedreven economie van het land. Aruba is een eiland in het zuidelijke deel van de Caribische Zee en staat bekend om haar aantrekkelijke belasting- en regelgevingsklimaat, waardoor het een aantrekkelijke bestemming is voor internationale investeerders en financiële dienstverleners.

Sint Maarten is een deelstaat van het Koninkrijk der Nederlanden, gelegen in het noordoosten van de Caribische Zee. Het deelt het eiland Sint Maarten met de Franse overzeese gemeenschap Saint-Martin. Maarten staat bekend om zijn toerisme-industrie, maar heeft ook een zich ontwikkelende financiële dienstensector die zich richt op zowel binnenlandse als internationale klanten.

Bonaire is samen met Sint Eustatius en Saba een bijzondere gemeente van Nederland in het Caribisch gebied. Bonaire staat bekend om zijn prachtige natuurlijke landschappen en is een populaire bestemming voor duiken en ecotoerisme. De financiële dienstensector op Bonaire is echter relatief klein in vergelijking met andere Caribische jurisdicties.

Wij geven u de controle

Blijf op de hoogte

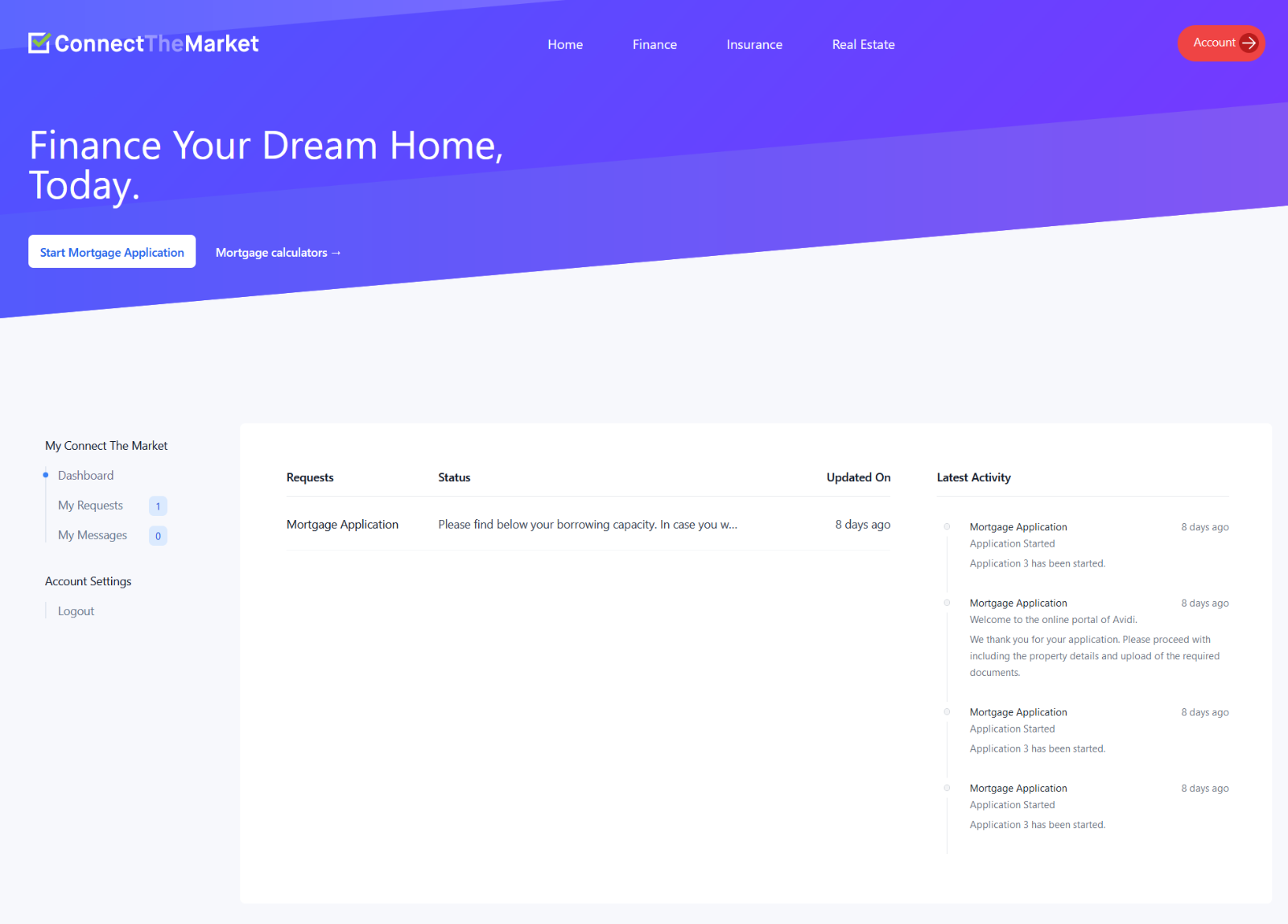

Vroeger kon je bij het aanvragen van een hypotheek bij banken op Curacao en St. Maarten weken, zelfs maanden wachten voordat je de duidelijkheid krijgt die je zoekt over de voorwaarden en beschikbaarheid van een hypothecaire lening. Eerst moet je eindeloos papierwerk invullen en terugsturen naar het kantoor van de bank, wat het niet alleen tijdrovend maar ook een frustrerend proces maakt. Bovendien ben je er niet zeker van dat het de beste deal is die op de markt verkrijgbaar is.

Connect The Market heeft de oplossing voor jou.

Dien online een aanvraag in en ontvang direct een voorlopige deal. Ons algoritme berekent automatisch hoeveel je kunt lenen en biedt je de beste rentetarieven die beschikbaar zijn. Bespaar geld op je hypotheekbetalingen en krijg de meest betaalbare verzekering. Bespaar tijd, geld en blijf ontspannen. Connect The Market has got you covered!

Log in met een code welke per e-mail is toegestuurd.

Je hebt geen wachtwoord nodig.

Kies het financiële product dat u wenst.

Vul uw online aanvraagformulier in enkele minuten in.

Ontvang direct de beste hypotheekdeal op de markt!

Bekijk direct uw voorlopige deal online. Geen wachttijden, geen

hoofdpijn.

Upload bewijsstukken veilig online.

De geüploade documenten worden versleuteld en

alleen gedeeld met de betrouwbare aanbieder die uw deal aanbiedt.

Ontvang na controle door de financiële instelling de beste

hypotheekdeal die voor u beschikbaar is!

Onderteken uw contracten elektronisch, online en rond uw

hypotheekdeal af.

Financiering

Het aanvragen van een hypotheeklening bij traditionele banken op Curaçao, Sint Maarten of andere Nederlands-Caribische eilanden kan veel tijd in beslag nemen, voordat je een duidelijk aanbod krijgt. Het onboardingproces is vaak omslachtig en onduidelijk. En als je dan een aanbod krijgt, weet je niet zeker of dit het beste aanbod op de markt is. Connect The Market heeft de oplossing voor jou.

Meld je online aan en ontvang direct voorlopige aanbiedingen. Ons algoritme berekent automatisch hoeveel je kunt lenen en biedt je de beste rentetarieven die beschikbaar zijn. Bespaar geld op je hypotheekbetalingen en krijg de meest betaalbare verzekeringen. Bespaar tijd en geld en neem het heft in eigen handen. Connect The Market has got you covered!